Posts

- Advantages and disadvantages from Identity Deposits

- BOK Economic Advertisements: Greatest Offers and you may Incentives

- Build attention during the a fixed price to own a-flat period

- Uh-oh! This really is a private tale readily available for chose clients merely.

- Ready to obtain the things need and become inside the funds?

Early withdrawal away from repaired deposit normally sells a punishment. Other banking institutions impose various other penalty fees, and it also typically relates to a decrease in rate of interest. Fixed dumps (FDs) had been a go-so you can funding selection for generations inside the Asia, with the low-chance profile and you will protected output. It is a preferred selection for those seeking to invest their discounts and you may earn a fixed rate of interest more than a specific months. Although not, items get occur in which you need withdraw the FD ahead of its maturity time, possibly in order to serve an unanticipated disaster or perhaps to purchase a successful investment options. You will have to definitely spend the money for minimum quantity they need by the schedules they set, and can be safest by the head debit online, yet not, aside from so it, you could potentially spend as often more as you wish.

Within the a decreased interest ecosystem, need for label dumps can be fall off since the traders is also normally see alternative funding vehicle you to shell out increased rate. Banking institutions is enterprises; as such, they would like to pay the reduced speed possible for name deposits and you will charge a higher rate so you can individuals to own money. Label deposits is actually a very secure investment and are for this reason really appealing to conservative, low-chance people. The brand new monetary devices are sold by the banks, thrift establishments, and borrowing unions.

One to problem are the price of strengthening a vault to own safe deposit packages set enterprises in debt almost instantaneously. While the risks are generally very low, incidents can be lay stress to your a finance business fund. Such as, there is certainly abrupt changes inside the interest levels, biggest credit high quality downgrades for multiple organizations and you may/otherwise increased redemptions one were not envisioned. Within the 2008 but not, a single day immediately after Lehman Brothers Holdings Inc. registered to possess case of bankruptcy, one to currency industry finance dropped to 97 cents once writing out of your debt it owned that was given because of the Lehman.

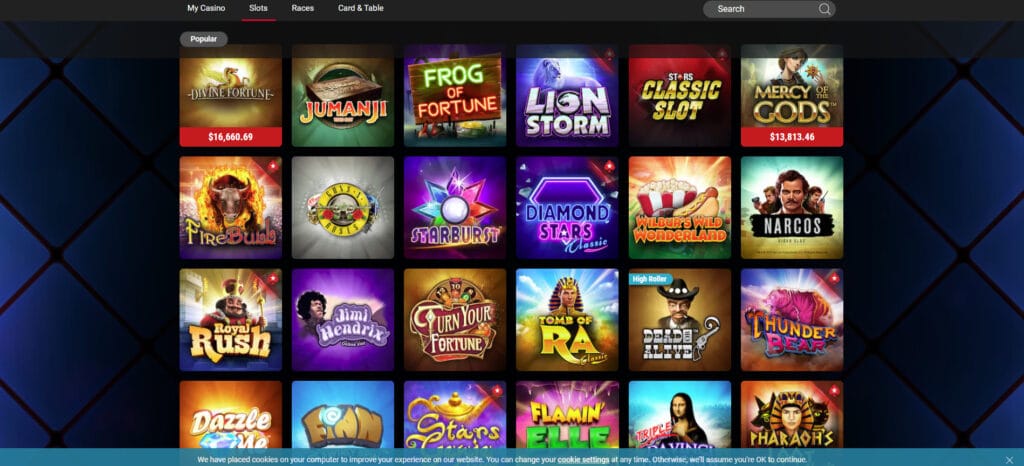

If you are eager to give it a try to the fun position Split The new Piggy-bank, the brand new free trial game is an excellent choice. Still, this can be may be the most practical way to experience the newest casino slot games instead risking anything. Tax-saver repaired deposits usually lack a premature closing facility because they include a lock-inside age of 5 years. Sure, certain https://happy-gambler.com/betspace-casino/ financial institutions allow it to be limited detachment from FD just before maturity, nevertheless usually includes certain criteria and you will smaller interest levels. M&T Bank provided a funds incentive out of $350 when you opened a MyChoice Premium Checking account. To achieve the advantage, you had in order to maintain the typical month-to-month equilibrium with a minimum of $10,100000 for June and you may July.

If you’d like totally free favourite casino games, you might play which lender heist inspired position during the Slotozilla.com free of charge. No membership otherwise install is necessary, however, rather than 100 percent free slot game having incentive has, Hurt you wallet doesn’t provide one bonus rounds otherwise totally free revolves. It brings up a lot more diversity for the old-fashioned classic position, and a method to earn, as the crazy lender safe symbol completes gains and you can multiplies him or her by the 2 otherwise 4 if you get 1 or 2 out of such icons. The best time to look at a good Cd try once you have at least 3 months’ worth of earnings getting demand for an emergency finance, optimally in the a high-give checking account. Any extra deals sat on the subs bench is fantastic an excellent Computer game membership, or multiple Dvds for many who’re also setting up a Computer game ladder. That way, your own emergency deals remains available if you want they, while you are their Computer game account give you a steady flow of interest.

Advantages and disadvantages from Identity Deposits

Kotak, the administrators, group, and you may members should never be responsible otherwise accountable for people damage otherwise losings as a result of or arising because of dependence on or access to people advice contains here. Though you are often liberated to crack a keen FD ahead of readiness, you should know about the new penalties and the options in order to cracking one to. While you are nevertheless unclear about the choice out of cracking a keen FD ahead of maturity, don’t worry. “When you are for the reason that form of sneakers, you must work with the lending company, as you might not be capable personal the newest account or change the account until it matures,” Tumin told you.

BOK Economic Advertisements: Greatest Offers and you may Incentives

A phrase put is a savings equipment in which money is placed for the a merchant account at the a lender. Term put opportunities often have brief-name maturities between a month to a few years, features varying quantities of expected lowest deposits, and you may spend a fixed interest rate for the buyer. FDIC insurance coverage began inside 1933 as a part of the brand new Bargain, around if safe-deposit world was at the brand new height of the strength. However, as opposed to regular deposit profile, safe deposit packets are not FDIC-covered — and therefore when the a very important item disappears or perhaps is forgotten, safe-deposit consumers have little way to get their funds right back.

Build attention during the a fixed price to own a-flat period

The fresh competition manager reserves the right to reduce, suspend, otherwise terminate people an element of the knowledge if the climate conditions deem they hazardous to the people otherwise damaging to the category. Even though Break your budget are forced to terminate for any excuse as well as the experience can not be feasibly rescheduled, refunds/race credits/rollovers will not be considering. This consists of, although not limited by, COVID-19, bird flu virus, wildfires, quality of air, natural disasters, providing department closures, an such like.Be assured, we want which knowledge to visit of since the arranged as frequently because you manage.

This is where the brand new understated art of cash laundering comes in, and you can take advantage of it to sidestep the new limits. As well, by using away a nine-few days Cd from the Synchrony Bank, you’ll owe just ninety days out of easy desire for those who withdraw very early. Such, you could find a no-penalty Cd during the step 3.50% APY than the a timeless Video game during the cuatro.00% APY.

Uh-oh! This really is a private tale readily available for chose clients merely.

And make an offline detachment, visit your lender department and you will complete a form for closure your own FD membership early. You ought to along with finish the expected documents and give their Fixed Deposit Receipt. Inside the today’s unclear economy, old-fashioned and lower-exposure funding alternatives continue to dominate your options away from Indian savers. The fresh articles herein are just for informative motives and you can universal inside nature.

- Products in the assessment tables try sorted considering certain issues, as well as device have, rates of interest, costs, prominence, and you can industrial preparations.

- Although not, for it you’re going to have to purchase for a longer time compared to the time of the broken FD.

- Fl rules makes you deduct specific expenses in the security deposit.

- SBI FD members is romantic its accounts by using the part financial channel.

Although Dvds fees an early withdrawal penalty, high-yield discounts accounts allows you to put and you will withdraw money and in case you want. Now, label put costs is actually of up to they’ve started for a long time, and with then bucks rate expands you’ll be able to, it’s most likely the new upcoming months will find prices go up even a lot more. For now, Judo Lender, a great neobank established in 2016, provides the higher long lasting put prices. Label places is actually discounts profile for which you store your finances for a fixed time frame and you can secure interest. You can not get rid of your bank account for the months lest you have to pay a penalty. “Name deposit” is the general label, and you may according to the region, is employed instead of “certificate away from put.”

Find all of our full directory of a knowledgeable step one-few days Video game cost with other finest picks. The first withdrawal punishment is actually sometimes $50 or perhaps the amount the following, any kind of is actually better. See the complete list of the best 9-week Computer game costs with other greatest picks. Come across all of our complete directory of the best step three-week Computer game costs to many other best picks. Find all of our full listing of a knowledgeable 6-month Cd rates to other best selections.

Ready to obtain the things need and become inside the funds?

For example, buyers having licenses from put that will be over the exposure restriction could be locked within their investment if they want to avoid to pay a punishment for a young withdrawal. For those who have a criticism facing the property manager regarding your defense put, you have got several options. Earliest, you can look at to respond to the challenge individually with your property manager.

For more information, comprehend InfoChoice.com.au’s Financial Characteristics and Borrowing Guide (FSCG). NAB’s rates protection level is a lot like the other banking companies, however, to the harmony, the fresh percentage reductions are available a little shorter harsh, however these might be used as the a guide simply. Few people and you will companies – including the RBA – have predict the brand new fast escalation in rates of interest away from middle-2022 to late-2023 to obtain inflation down.